Digital Systems Expected to Drive 5% Annual Growth in PCR Testing Products

The total market for PCR products will likely top $5 billion in 2023, according to a new report.

While the COVID-19 pandemic made it “famous,” polymerase chain reaction (PCR) testing has long been a crucial sector of the global lab testing industry. With an expected compound annual growth rate (CAGR) of five percent through 2026, the total market for PCR products will likely top $5 billion in 2023, according to a new report from market research firm Strategic Directions International (SDi).1 Here’s a quick briefing of global PCR products trends based on the report and the estimates of other analysts.

The PCR Products Market

All organisms contain DNA and RNA. PCR tests and real-time (RT) PCR tests detect genetic material from specific viruses and other pathogens that cause infections. In addition to being highly accurate, PCR tests can detect evidence of disease during the earliest stages of infection. These qualities have made PCR testing the primary form of diagnosing the SARS-CoV-2 virus that causes COVID-19, particularly in the earliest stages of the public health emergency. Samples for PCR tests are typically drawn from the sinus cavity using a long swab. The genetic material contained in these samples is then copied multiple times to make the pathogens easier to detect.

While the need to detect diseases is the primary driver of market growth, PCR tests are also used for cloning, genotyping, mutation testing, paternity testing, sequencing, and microarrays. PCR testing techniques include traditional PCR, real-time PCR (RT-PCR), and digital PCR (dPCR).

The PCR market consists of sales of PCR tests and related products, including reagents, instruments, software, and services. However, the SDi report focuses not on clinical in vitro diagnostics (IVD) applications but rather research uses of PCR instrumentation, consumables, and service contracts in applications like lab developed testing, sequencing, and environmental monitoring.

To perform its study, SDi surveyed PCR users at research labs in North America, Europe, and Asia to determine usage, brand preferences, and other purchasing patterns while drawing on its market research database to estimate market size and growth rates. The SDi market estimates account for both initial instrument purchases as well as aftermarket sales, such as components and consumables.

dPCR Drives Growth

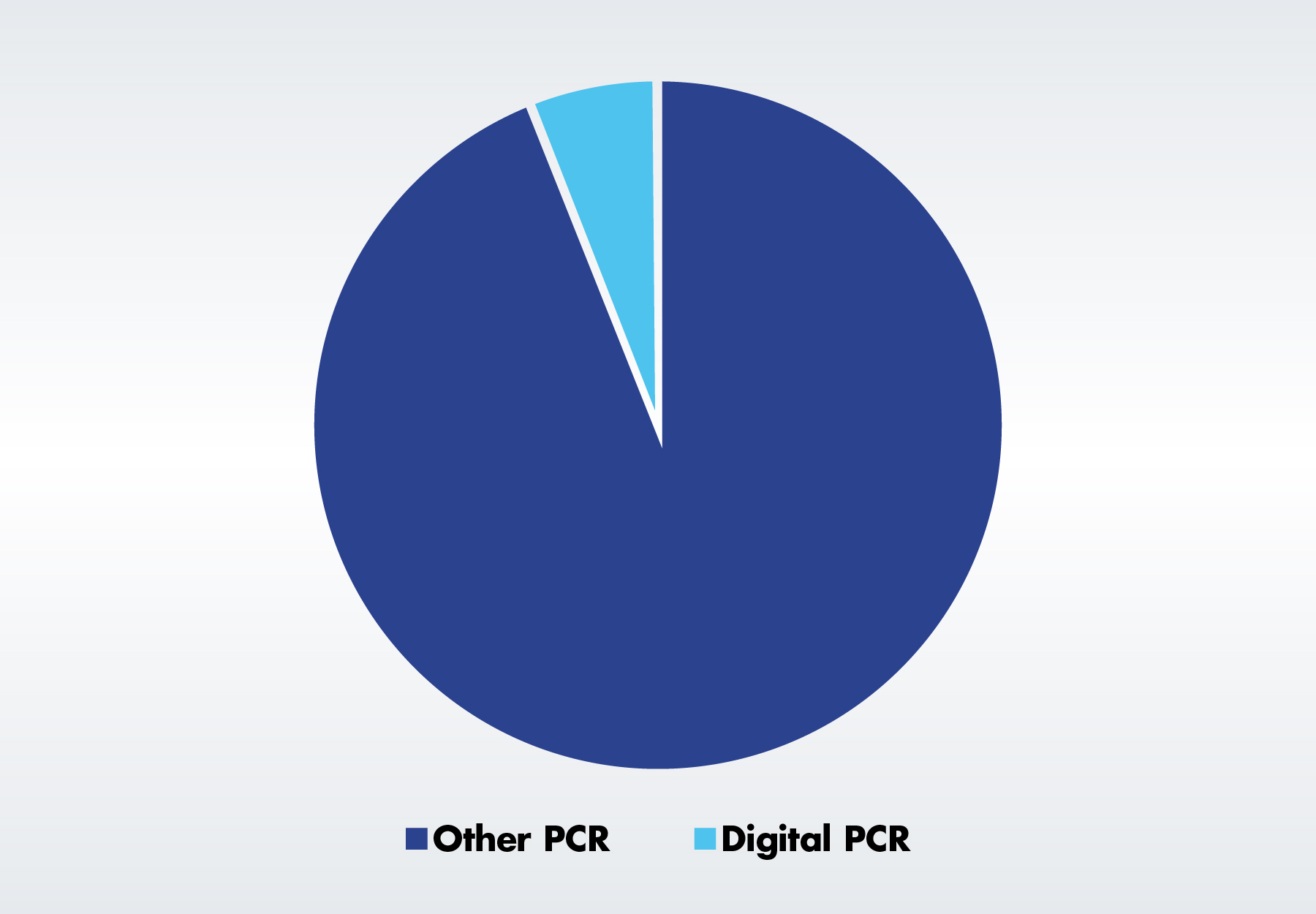

By PCR technology, dPCR is the fastest growing, with key applications including rare mutation detection, copy number variation analysis, and microbial pathogen detection. In addition to offering greater accuracy in the presence of inhibitors, dPCR allows for accurate quantification when the amplification efficiency is low, the report explains.

In 2006, Fluidigm launched the first dPCR system, the BioMark System. The market grew further in 2011 when Bio-Rad Laboratories acquired QuantaLife and rolled out the latter’s Droplet Digital (ddPCR) technology. Since then, a number of key quantitative PCR (qPCR) providers, including Roche and Qiagen, have gotten into the market. Bio-Rad Laboratories, Fluidigm, and Thermo Fisher Scientific are among the other companies that currently offer dPCR instruments. The SDi report concludes that dPCR adoption has grown quickly, with over 40 percent of the 248 scientists surveyed stating that they use it in their own labs.

2021 PCR Market Demand

Future Growth

Need for early detection of chronic diseases is expected to drive growth in all segments of the PCR products market. Other analysts that include clinical IVD applications in their totals estimate growth well beyond the five percent CAGR projected by SDi. However, all agree that the Russian invasion of Ukraine, surges in commodity prices, and supply chain disruptions have and will continue to act as a drag on growth, at least in the near term.2 Long-term growth in PCR products could also be slowed by the rise of alternative, more rapid technologies for disease detection such as CRISPR-based systems.

References:

Subscribe to view Essential

Start a Free Trial for immediate access to this article