Compliance Alert: OIG Sounds the Alarm on Medicare Overpayments for Physician Services Provided to Inpatients

According to a recent report, Medicare overpaid for such services over a two-year period between 2019 and 2020.

A newly published report from the U.S. Department of Health and Human Services Office of Inspector General (OIG) may have direct compliance implications for labs if their physicians billed Medicare for services provided to inpatients over the past six years.

According to OIG Report (A-04-21-04084), Medicare spent over $22 million in overpayments to physicians for services provided to Part A skilled nursing facilities (SNF) or hospital inpatients over a two-year period between 2019 and 2020.1 Now OIG wants the Centers for Medicare & Medicaid Services (CMS) to get that money back. More significantly for labs, it wants providers to determine whether they received any such overpayments and, if so, report and refund them in accordance with 60-day self-reporting rules.

Medicare Inpatient Physician Services Coverage Rules

Under Medicare Part A, SNFs, hospitals, and other inpatient facilities receive payment at a bundled rate covering all services provided to an inpatient during the stay. Physicians and nonphysician practitioners (NPPs) (which we’ll refer to collectively as “physicians” for simplicity’s sake) are reimbursed under Medicare Part B at the rate specified in the Medicare Physician Fee Schedule (MPFS).

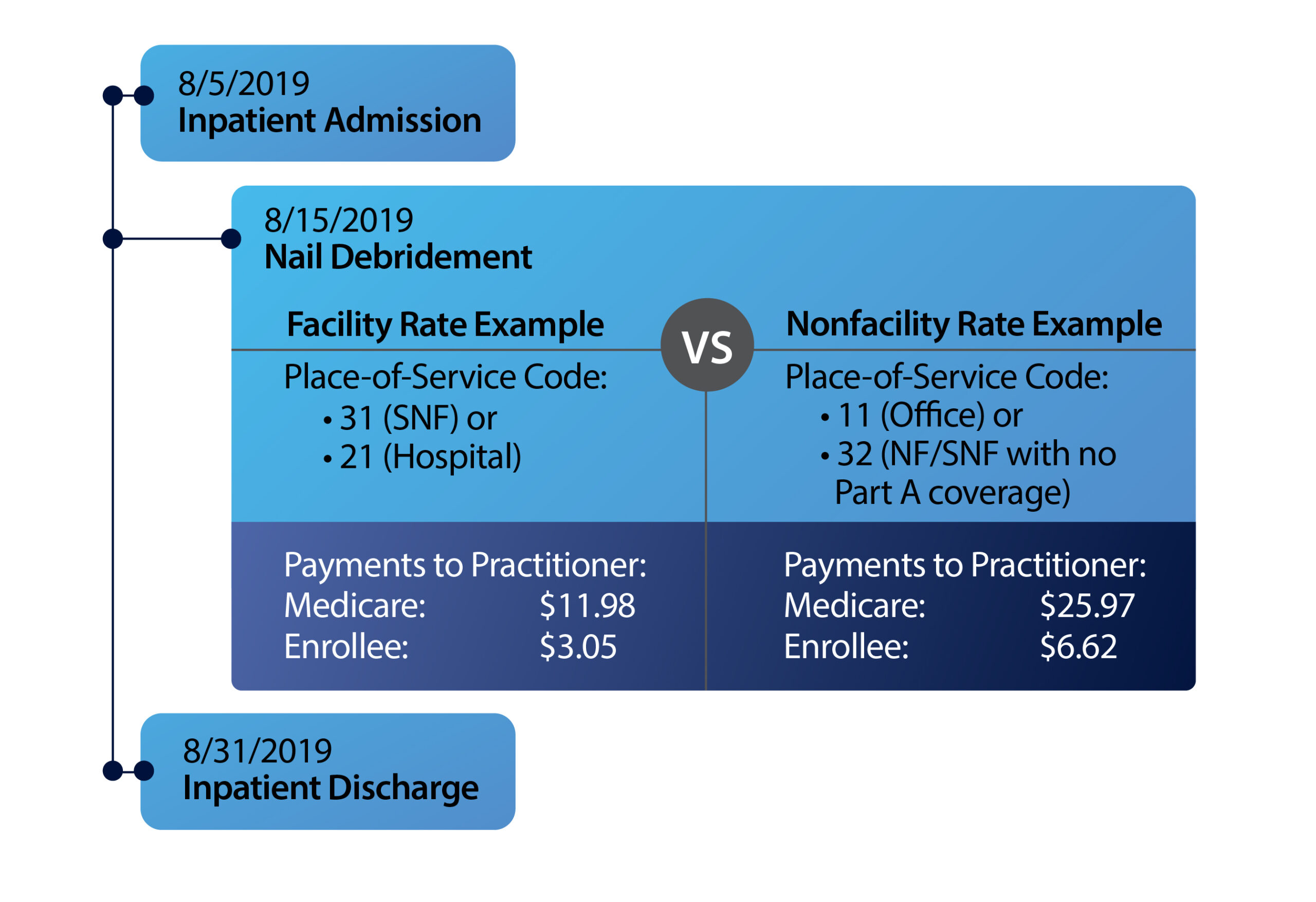

These separate reimbursement schemes interact when physicians provide services to inpatients of Part A facilities. Because services from physicians are included in the Part A payment to the facility, Medicare pays those who provide services to Part A inpatients at the facility rate, which is below the MPFS amount that would have applied had the services been provided on an outpatient basis (the nonfacility rate). The differences in facility and nonfacility payment rates can be substantial, especially when multiple claims are involved, as shown by the examples below.

Examples of Physician/NPP Services with Different Facility & Nonfacility Payment Rates

| HCPCS Code | HCPCS Code Description | Facility Rate* | Nonfacility Rate* | Difference |

| 11043 | Removal of skin and/or muscle, first 20 square centimeters or less | $161.32 | $239.64 | $78.32 |

| 11720 | Removal of tissue from 1–5 fingernails or toenails (nail debridement) | $15.16 | $33.56 | $18.40 |

| 90791 | Psychiatric diagnostic evaluation | $127.76 | $145.44 | $17.68 |

| 92004 | Eye and medical examination for diagnosis and treatment, new patient, one or more visits | $99.97 | $152.66 | $52.69 |

| 99214 | Established patient office or other outpatient, visit typically 25 minutes | $80.48 | $110.43 | $29.95 |

Physicians are supposed to report a two-digit place-of-service code on a Medicare claim line indicating where they performed the billed service. Medicare can then use this code to determine whether to pay the facility or nonfacility rate.

Examples of Place-of-Service Codes & Respective Designated Payment Rate

| Code | Code Name | Facility Rate | Nonfacility Rate |

| 11 | Office | √ | |

| 21 | Hospital | √ | |

| 31 | Skilled Nursing Facility (SNF with Part A coverage) | √ | |

| 32 | Nursing Facility (NF or SNF with no Part A coverage) | √ |

The OIG Audit

However, the OIG has found that physicians haven’t been following CMS regulations and coding guidance when reporting the place-of-service code on a claim line, thereby exposing Medicare to a risk of overpayments for physician services provided to inpatients. The OIG reached this conclusion after auditing more than 2.1 million physician service claim lines covering more than $171 million in Medicare Part B payments with dates of service between January 1, 2019, and December 31, 2020. In each case, the audited claim line pertained to services furnished to a Part A hospital or SNF inpatient for which the physician used a nonfacility place-of-service code.

The OIG found that over the two-year period, Medicare made $22,463,193 in overpayments for 1,130,182 claim lines for physician services that should have been billed at the facility rate, rather than the higher nonfacility rate.

Since the Part A payment to the facility already covered physician services, Medicare essentially paid twice for these services. Wrongful use of the nonfacility place-of-service code by physicians also cost inpatients who received these services up to $5,706,079 in additional cost-sharing for deductibles and coinsurance they shouldn’t have been charged.

What Went Wrong?

The OIG report also identifies the systemic flaw that allowed these overpayments to happen, namely, lack of coding edits in the CMS’s Common Working File (CWF) system.

Explanation: Medicare Administrative Contractors (MACs) use the Fiscal Intermediary Standard System to process inpatient claims submitted by facilities and the Multi-Carrier System to process claims for physician services. The CWF is the clearinghouse that claims processed by both systems must move through for verification, validation, and authorization before payment is made.

The CWF system contains both prepayment and postpayment edits designed to flag and prevent overpayments, including verification that services on a claim haven’t already been paid on another claim. But the system doesn’t have edits to compare Part A hospital and SNF inpatient claims to Part B claims for physician services.

This means the system can’t assess the proper place-of-service code for the Part B claim line and verify that the payment rate is appropriate when the patient being billed for is an inpatient. Consequently, the CWF system can’t detect when a Part B payment for services to an inpatient billed at the nonfacility rate should actually be paid at the lower facility rate.

Example of Part A Claim & Part B Claim Line Not Compared by CWF Edits to Assess Proper Payment Rate

The OIG cites other flaws in the system, including the fact that CWF edits are limited to the fields available on a claim, which don’t include fields showing when a patient leaves and returns to a facility on the same day.

Practical Impact: The 60-Day Overpayment Self-Reporting Clock May Start Ticking

The OIG Report has direct implications for physicians, labs, and other provider organizations that might have listed the improper place-of-service code on a Part B claim line for physician services provided to Medicare beneficiaries while they were inpatients of a Part A hospital or SNF in the past six years. That’s because under the Medicare Reporting and Returning of Self-Identified Overpayments Rule (aka, the 60-Day and Six-Year Lookback Period Rule) labs and other providers that receive “credible information” about potential overpayments are required to exercise “reasonable diligence” to determine whether they’ve received any such overpayments and, if so, quantify the amount they received during a six-year period. Providers must then report and return any overpayments they identify by the later of:2

-

- 60 days after identifying the overpayments or;

- the date that any corresponding cost report is due (if applicable).

The key compliance takeaway is the OIG specifies that the audit report does constitute “credible information” of potential overpayments triggering the 60-Day and Six-Year Lookback Rules.1

The OIG also made six recommendations, the first two of which CMS has accepted:

-

- Instruct MACs to reprocess the claims with the inaccurate place-of-service codes to recover the $22.5 million in overpayments identified in the audit; and

- Have MACs notify applicable providers of the potential for overpayments so that they can comply with their 60-Day Rule obligation to “exercise reasonable diligence to identify, report, and return any overpayments.”1

Bottom Line: Be on the lookout for potential overpayment notices from your MAC.

The OIG’s other four recommendations focus on how the CMS can fix the problems that led to overpayments and prevent them from recurring in the future by:

3. Incorporating CWF edits to detect cases in which physicians incorrectly use the nonfacility place-of-service code for an SNF while an enrollee is a Part A SNF inpatient;

4. Taking the necessary legislative or regulatory actions to ensure that Medicare pays the facility rate for physician services furnished while enrollees are Part A SNF or hospital inpatients, irrespective of where the services are actually furnished, or otherwise ensure that Medicare doesn’t pay twice for the same expenses;

5. Considering whether to create a mechanism for Part A facilities to indicate when an inpatient leaves a facility and returns the same day; and

6. Providing additional education to practitioners on the appropriate use of place-of-service codes.

CMS concurred with recommendations three and six but chose to reserve judgment on recommendations four and five.

References:

Subscribe to view Essential

Start a Free Trial for immediate access to this article