COVID-19, Genetic Tests Wipe Out Medicare Part B Lab Test Savings

Even though PAMA has slashed reimbursement rates for many tests, overall Medicare Part B spending on lab tests continues to increase.

Four fiscal years have passed since the Protecting Access to Medicare Act of 2014 (PAMA) took effect. Even though PAMA has slashed reimbursement rates for many tests, overall Medicare Part B spending on lab tests continues to increase. A new U.S. Department of Health and Human Services Office of Inspector General (OIG) report finds that the trend continued in FY 2021, with spending on lab testing increasing by $1.3 billion in 2021.1 Here’s a high-level briefing of the report and what it tells us about long-term Medicare lab test spending trends.

Part B Lab Test Reimbursement Under PAMA

Before PAMA was enacted in 2014, the common perception was that clinical labs were charging Medicare more than what they charged private payors for the same tests. PAMA was designed to rectify that imbalance and align what Medicare Part B pays for lab tests under the Clinical Laboratory Fee Schedule (CLFS) with the actual rates at which private payors reimburse those tests in the particular market where the tests are performed. The assumption was that market-based pricing would result in savings and an overall reduction in Medicare lab test spending without affecting test utilization.

Part B Lab Test Spending Under PAMA

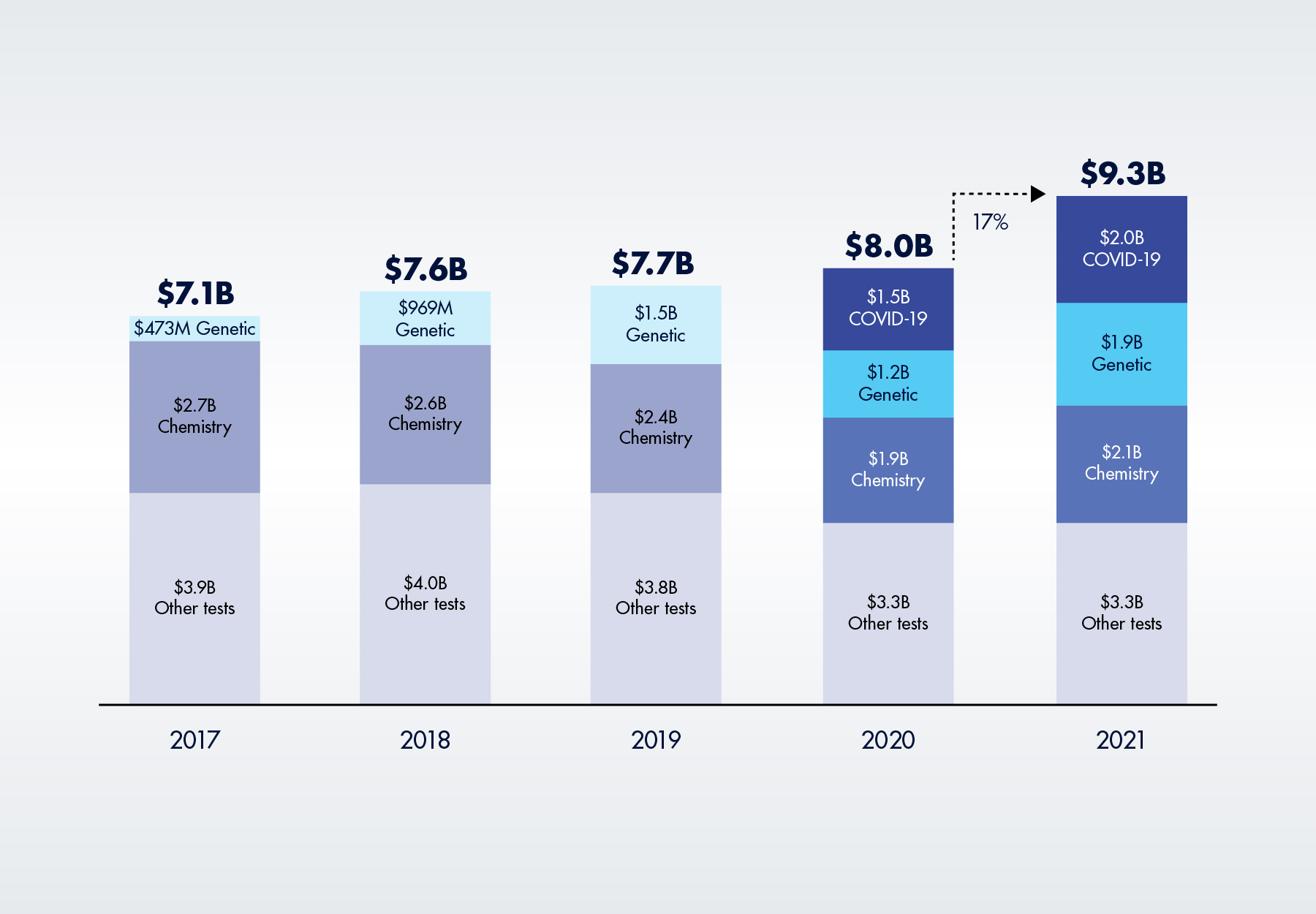

Things haven’t gone as planned. Medicare spending on lab tests has actually increased in all four years since the PAMA market-based pricing system, such as it is, officially took effect in 2018. The new OIG report concludes that Medicare Part B lab test spending increased from $8.0 billion in FY 2020 to $9.3 billion in FY 2021. The 17 percent year-over-year increase is the largest one-year change in spending since the OIG began monitoring payments in 2014, the report notes.

Figure 1. Average Annual Medicare Part B Lab Spending, 2017 to 2021 (in billions)

There are three explanations for these trends.

1. Steadily Higher Spending on Expensive Genetic Tests

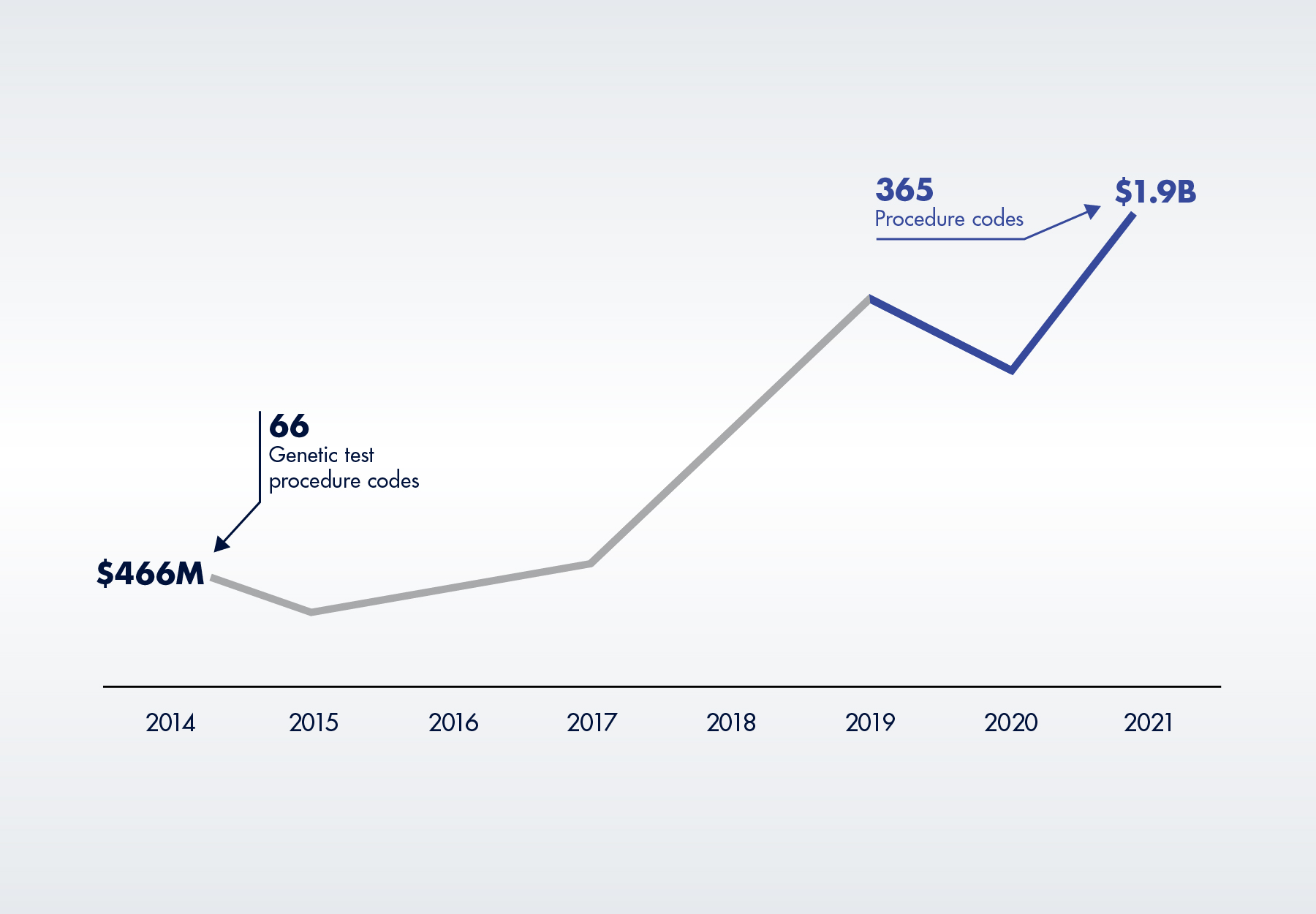

Greater spending on high-priced genetic tests, many of which are unaffected by PAMA, have more than offset any savings from PAMA CLFS rate reductions. According to the OIG, total Medicare Part B spending on four categories of genetic tests (molecular pathology tests, multianalyte algorithmic assays, genomic sequencing procedures and proprietary lab analysis tests) increased by 56 percent, from $1.2 billion in 2020 to $1.9 billion in 2021, exceeding pre-pandemic levels and accounting for 20 percent of all Medicare spending on lab tests. These are all high-priced tests, with a 2021 average payment of $666 per test. As illustrated in Figure 4 below, in 2021, five of the top 25 tests were high-priced genetic tests.

None of this is new. Medicare Part B spending for genetic tests has increased by over 300 percent since the OIG began monitoring in 2014, driven by an increase in both claims volume and the number of procedure codes eligible for payment.

Figure 2. Medicare Part B Spending on Genetic Tests, 2014 to 2021

2. 10 Percent Increase in Chemistry Tests

After declining in 2020, Medicare Part B spending on chemistry tests measuring the level of a protein, electrolyte, hormone, or other chemical in a specimen, increased 10 percent, from $1.9 billion to $2.1 billion in 2021. Although they average only about $13 per test, chemistry tests are the largest segment of the CLFS.

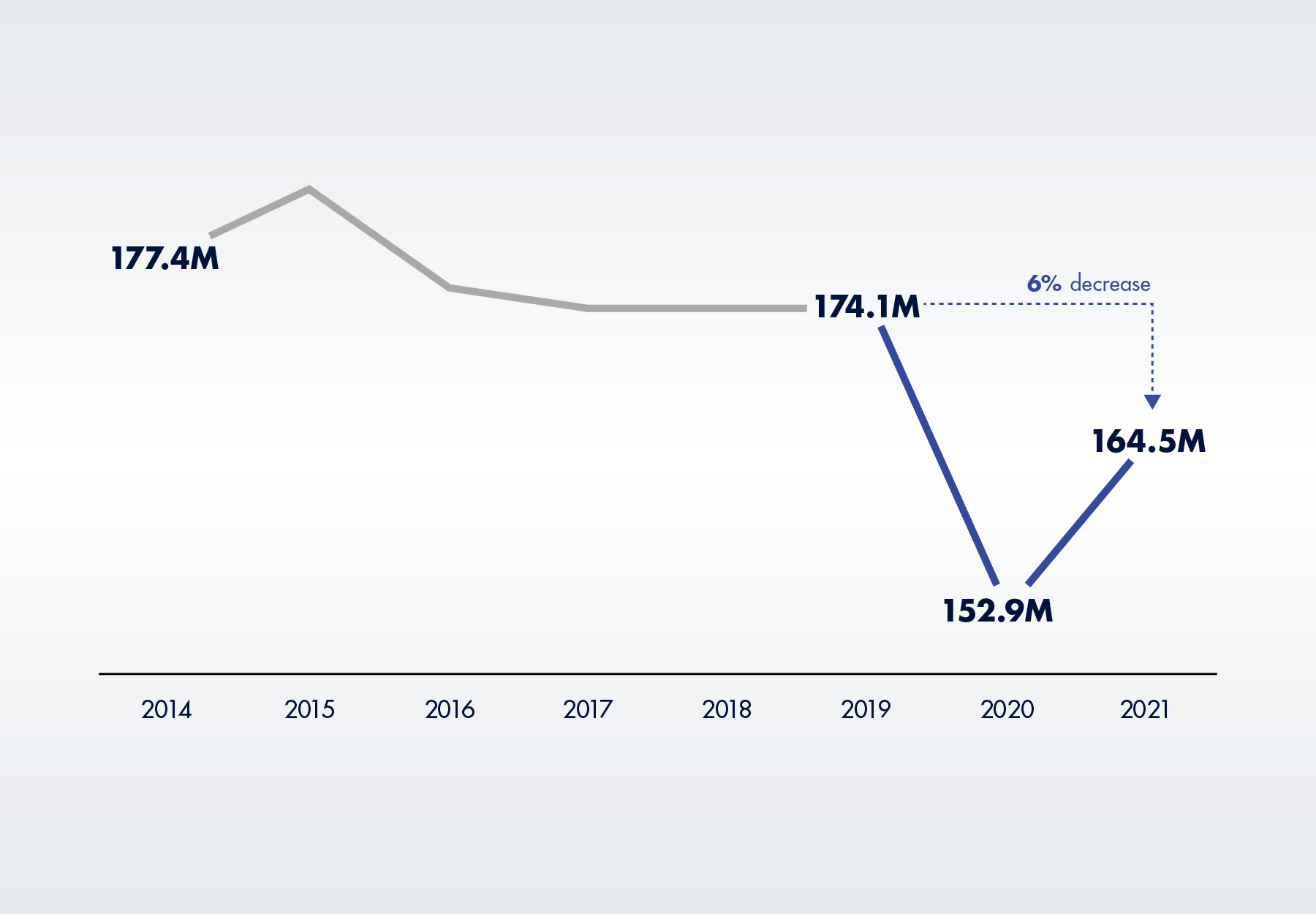

The increase was driven by higher test volumes, with 165 million tests performed. This is actually a positive to the extent it signifies that Medicare enrollees resumed at least some of the medical care they postponed during the pandemic. However, chemistry test volume still hasn’t returned to pre-pandemic levels, with 2021 test volume six percent below 2019 levels. “If fewer Medicare Part B enrollees received these tests, it could indicate that they may not have accessed healthcare at the same level as they did” before the pandemic began, according to the report.

Figure 3. Medicare Part B Chemistry Test Volume, 2014 to 2021

3. Unexpected Spending on COVID-19 Tests

Of course, the biggest reason for higher Medicare Part B spending on lab tests, at least in the past two years, is COVID-19 testing. Medicare Part B spent $1.56 billion on COVID-19 tests in 2020, as compared to $0 in 2019. Spending on COVID-19 tests in 2021 increased another $440 million to $2.0 billion across 26 procedure codes, including PCR, antibody, high-throughput, and panel tests, as well as a new code to incentivize faster test turnaround times. Year-over-year test volume also jumped 37 percent, from 18.8 million to 25.8 million tests. On average, Medicare paid for 2.6 COVID-19 tests per person in 2021, as compared to 2.2 tests per person in 2020.

The Top 25 Tests

PAMA also requires CMS to track and publicly release annual Part B lab spending information, specifically an OIG annual analysis of the top 25 tests under the CLFS, which is included in the new OIG report. At $5.5 billion, Medicare Part B spending on the top 25 tests increased by 10 percent in 2021. For the second year in a row, a high-throughput COVID-19 test (procedure code U0003) was the top procedure code for the year. But while volume for the test increased 22 percent, spending actually decreased due to a reimbursement cut (from $100 to $75) that CMS implemented at the start of the year. Here’s the entire top 25:

Figure 4. Top 25 Lab Tests Based on Medicare Part B Payments in 2021

| Rank | Test Description (Procedure Code) | 2021 Payment Rate | 2021 Test Volume (In Millions) | Volume Change from 2020 | 2021 Spending (In Millions) |

| 1 | COVID-19 test: Infectious agent detection by nucleic acid COVID-19, high-throughput (U0003) | $75 | 12.5 | +22.2% | $935.9 |

| 2 | Blood test, comprehensive group of blood chemicals (80053) | $10.56 | 39.5 | +4.7% | $425.3 |

| 3 | Blood test, lipids (80061) | $13.39 | 26.5 | +4.9% | $355.2 |

| 4 | Blood test, thyroid-stimulating hormone (TSH) (84443) | $16.80 | 19.9 | +5.3% | $334.4 |

| 5 | COVID-19 test: Add-on payment for high throughput tests completed within 2 calendar days of specimen collection (U0005) | $25.00 | 12.3 | New in 2021 | $305.4 |

| 6 | Complete blood cell count, automated test (85025) | $7.77 | 37.8 | +3.1% | $300.2 |

| 7 | Genetic test: Molecular pathology procedure level 9 (81408) | $2,000.00 | 0.1 | +36.4% | $282.2 |

| 8 | Vitamin D-3 level (82306) | $29.60 | 9.1 | +11.8% | $267.2 |

| 9 | Genetic test: Gene analysis (colorectal cancer) (81528) | $508.87 | 0.5 | +20.6% | $252.6 |

| 10 | COVID-19 test: Any technique, high-throughput technologies (U0004) | $75.00 | 2.9 | +20.7% | $220.8 |

| 11 | Detection test for organism (87798) | $35.09 | 6.1 | +16.2% | $213.7 |

| 12 | Drug test(s), definitive, 22 or more drug class(es) (G0483) | $246.92 | 0.8 | -9.2% | $203.0 |

| 13 | Hemoglobin A1C level (83036) | $9.71 | 18.6 | +5.9% | $182.3 |

| 14 | Testing for presence of drug (80307) | $62.14 | 2.5 | -3.6% | $156.4 |

| 15 | Drug test(s), definitive, 15-21 drug class(es) (G0482) | $198.74 | 0.7 | +1.3% | $130.2 |

| 16 | COVID-19 test: Amplified probe technique (87635) | -- | 2.0 | +46.9% | $104.8 |

| 17 | COVID-19 test: ELISA detection of severe acute respiratory syndrome coronavirus 2 (COVID-19) (87426) | -- | 2.6 | New to top 25 | $101.5 |

| 18 | Parathormone (parathyroid hormone) level (83970) | $41.28 | 2.5 | +8.6% | $101.4 |

| 19 | Genetic test: Gene analysis (breast cancer 1 and 2) (81162) | $1,824.88 | 0.05 | +7.7% | $94.0 |

| 20 | Genetic test: Test for detecting genes associated with breast cancer (81519) | $3,873.00 | 0.02 | +20.1% | $92.7 |

| 21 | Blood test, basic group of blood chemicals (80048) | $8.46 | 10.3 | -0.1% | $90.3 |

| 22 | Cyanocobalamin (vitamin B-12) level (82607) | $15.08 | 5.8 | +11.4% | $87.9 |

| 23 | Drug test(s), definitive, 1-7 drug class(es) (G0480) | $114.43 | 0.8 | -2.6% | $86.6 |

| 24 | Genetic test: Molecular pathology procedure level 8 (81407) | $846.27 | 0.1 | New to top 25 | $81.6 |

| 25 | Drug test(s), definitive, 8-14 drug class(es) (G0481) | $156.59 | 0.5 | -2.5% | $79.1 |

References:

Subscribe to view Essential

Start a Free Trial for immediate access to this article