COVID-19 Testing Drives Increase in Part B Medicare Lab Spending

Here’s a look at the key takeaways from the Dec. 30 OIG report on Medicare Part B spending on lab testing.

Medicare Part B spending on lab testing isn’t following the Protecting Access to Medicare Act (PAMA) script. In FY 2018 and 2019, the first two years under the PAMA system, Medicare payments under the Clinical Laboratory Fee Schedule (CLFS) actually increased. And now the OIG announced that the same happened in FY 2020. But, this time, the fly in the ointment was the $1.5 billion spent on COVID-19 testing; spending on non-COVID-19 tests actually did decline a bit. Here’s a look at the key takeaways from the Dec. 30 OIG report.

PAMA & Part B Lab Test Reimbursement

PAMA, which was enacted in 2014, was supposed to align Part B CLFS reimbursement rates for diagnostic lab tests with the prices private payors actually shell out for those tests in a particular market. The unspoken assumption was that labs were charging Medicare more than private payors. Market-based pricing would eliminate those disparities and reduce Medicare spending without affecting test utilization. The PAMA market-based pricing system, such as it is, was officially implemented in 2018.

The PAMA law also required CMS to track and publicly release annual Part B lab spending information, specifically an OIG annual analysis of the top 25 tests under the CLFS. On Dec. 30, the OIG reported the Medicare spending results from 2020.

Part B Medicare Lab Test Spending in 2020

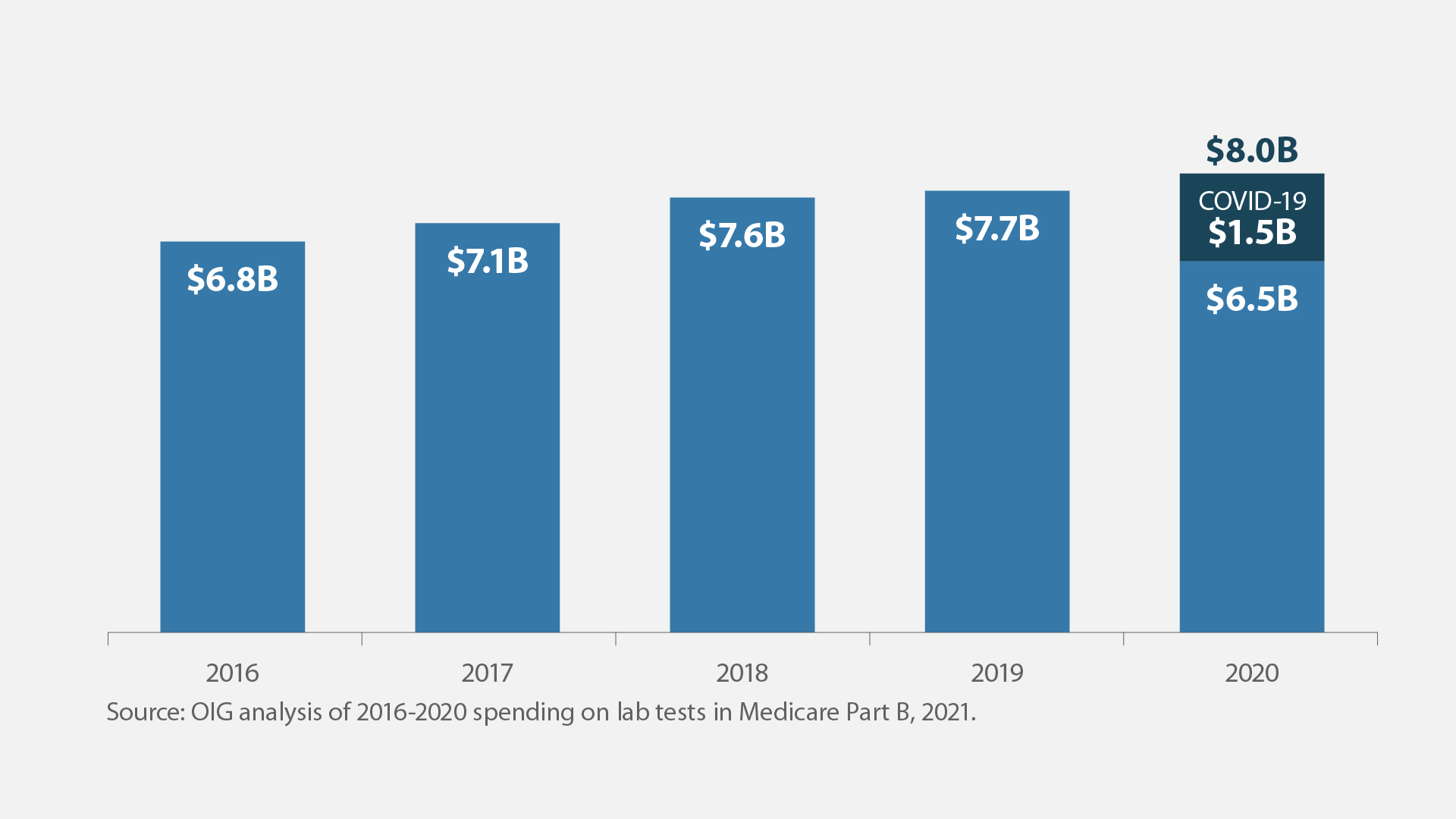

For the third straight year since the PAMA pricing system has been in place, overall year-over-year spending on lab tests increased in 2020, this time by 4.2 percent from $7.7 billion to $8.0 billion. This figure is in line with the average annual increase of 4.3 percent over the past five years.

Average Annual Part B Lab Spending, 2016 to 2020

However, the consistency in the 2020 increase numbers belies the narrative of what actually took place during the year. COVID-19 tests, which didn’t even exist before the pandemic, drove the increase in overall spending, accounting for about 19 percent of total Medicare Part B spending on lab tests during the year. In 2020, Medicare Part B spent $1.5 billion on COVID-19 tests, according to the OIG.

When COVID-19 tests were removed from the calculation, spending for all other tests as a group decreased by 15.9 percent from 2019, from $7.7 billion to $6.5 billion. However, this dip in spending on non-COVID-19 tests is also something of an outliner to the extent it resulted not just from PAMA price cuts but also the decline in overall health care utilization during the pandemic.

The Top 25 Tests

At $4.99 billion, Medicare Part B spending on the top 25 tests increased by eight percent in 2020. After not existing in 2019, four different COVID-19 tests cracked the top 25 in 2020, including the rapid COVID-19 test (procedure code U0003) that was number 1 on the list, with $1.02 billion paid for more than 10 million of the tests. “This marks the first time a new test entered the top 25 as the number 1 test since OIG began monitoring spending on the top 25 tests in 2014,” the report notes.

The number 2 test in 2020, the comprehensive group of blood chemicals test (procedure code 80053), had been the top test since new payment rates took effect in 2018. Utilization of this blood chemicals test declined by 10 percent, from 42.2 million in 2019 to 37.8 million in 2020, and payments declined by 18 percent, according to the OIG.

Spending on 20 of the 21 non-COVID-19 tests in the top 25 decreased from 2019 to 2020, including routine screening tests of the asymptomatic to determine the need for early intervention. Similarly, volume for each of the cancer screening tests in the top 25 decreased.

Only one non-COVID-19 test in the top 25 increased from 2020: a microbiology test that uses nucleic acid to detect an infectious agent (line 11 in table below). Volume for this test, which the OIG notes was likely used in conjunction with COVID-19 tests, increased by 92 percent while spending on the test increased by 78 percent.

Top 25 Lab Tests Based on Medicare Part B Payments in 2020

| Rank | Test Description (Procedure Code) | 2020 Payment Rate | 2020 Test Volume (in millions) | Volume Change from 2019 | 2020 Spending (in millions) |

| 1 | COVID-19 test: Infectious agent detection by nucleic acid COVID-19, high-throughput (U0003) | $100 | 10.2 | NEW | $1,017.0 |

| 2 | Blood test, comprehensive group of blood chemicals (80053) | $10.56 | 37.8 | -10% | $402.7 |

| 3 | Blood test, lipids (80061) | $13.39 | 25.2 | -12% | $336.2 |

| 4 | Blood test, thyroid-stimulating hormone (TSH) (84443) | $16.80 | 18.9 | -12% | $315.4 |

| 5 | Complete blood cell count, automated test (85025) | $7.77 | 36.7 | -11% | $288.5 |

| 6 | COVID-19 test: Any technique, high-throughput technologies (U0004) | $100 | 2.4 | NEW | $243.4 |

| 7 | Vitamin D-3 level (82306) | $29.60 | 8.1 | -9% | $237.6 |

| 8 | Drug test(s), definitive, 22 or more drug class(es) (G0483) | $246.92 | 0.9 | -29% | $221.9 |

| 9 | Gene analysis (colorectal cancer) (81528) | $508.87 | 0.4 | -14% | $208.1 |

| 10 | Molecular pathology procedure level 9 (81408) | $2,000 | 0.1 | -31% | $205.4 |

| 11 | Detection test for organism (87798) | $35.09 | 5.2 | +92% | $183.5 |

| 12 | Hemoglobin A1C level (83036) | $9.71 | 17.6 | -12% | $170.9 |

| 13 | Testing for presence of drug (80307) | $62.14 | 2.6 | -24% | $161.0 |

| 14 | Drug test(s), definitive, 15-21 drug class(es) (G0482) | $198.74 | 0.7 | -20% | $127.7 |

| 15 | Parathormone (parathyroid hormone) level (83970) | $41.28 | 2.3 | -8% | $92.8 |

| 16 | Blood test, basic group of blood chemicals (80048) | $8.46 | 10.3 | -18% | $89.6 |

| 17 | Drug test(s), definitive, 1-7 drug class(es) (G0480) | $114.43 | 0.8 | -26% | $87.8 |

| 18 | Gene analysis (breast cancer 1 and 2) (81162) | $1,824.88 | 0.05 | -21% | $86.7 |

| 19 | Drug test(s), definitive, 8-14 drug class(es) (G0481) | $156.59 | 0.5 | -17% | $80.5 |

| 20 | Cyanocobalamin (vitamin B-12) level (82607) | $15.08 | 5.2 | -11% | $78.4 |

| 21 | DNA gene analysis of 324 genes in solid organ tumor tissue (0037U) | $3,500 | 0.02 | -3% | $76.8 |

| 22 | Test for detecting genes associated with breast cancer (81519) | $3,873 | 0.02 | -9% | $76.6 |

| 23 | PSA (prostate specific antigen) measurement (84153) | $18.39 | 4.0 | -8% | $73.8 |

| 24 | COVID-19 test: Amplified probe technique (87635) | — | 1.4 | NEW | $70.8 |

| 25 | COVID-19 test: Any technique (U0002) | — | 1.2 | NEW | $60.7 |

Source: OIG Report, December 30, 2021

Subscribe to view Essential

Start a Free Trial for immediate access to this article