Digital Health Fundraising Falls in 2022 but May Not Have Bottomed Out

According to a new report, tough macro-economic conditions caused digital health fundraising levels to fall off dramatically in 2022.

The COVID-19 pandemic fueled a massive surge in digital health company investment. But the bubble has burst. After two years of record growth, tough macro-economic conditions caused digital health fundraising levels to fall off dramatically in 2022, according to a new report from venture capital analysis firm Rock Health.1 Here’s a quick briefing on the findings and what they may portend for digital health funding in 2023 and beyond.

The Digital Health Sector

To understand these numbers, it’s necessary to explain Rock Health’s methodology for analyzing digital health funding flows. Specifically, the firm defines digital health companies as those that build and sell technologies, including those paired with a service where the technology itself is the service. That includes companies like data warehouse platform builder Health Catalyst, online preventive health programs designer Omada Health, and Sotera Wireless, developer of the ViSi Mobile Patient Monitoring System.

Rock Health doesn’t count companies that are innovative but focus on selling labor-intensive services, rather than technology. Such firms include Access MediQuip, Oscar, and One Medical. The analysis also counts only deals of $2 million or more.

The 2022 Analysis

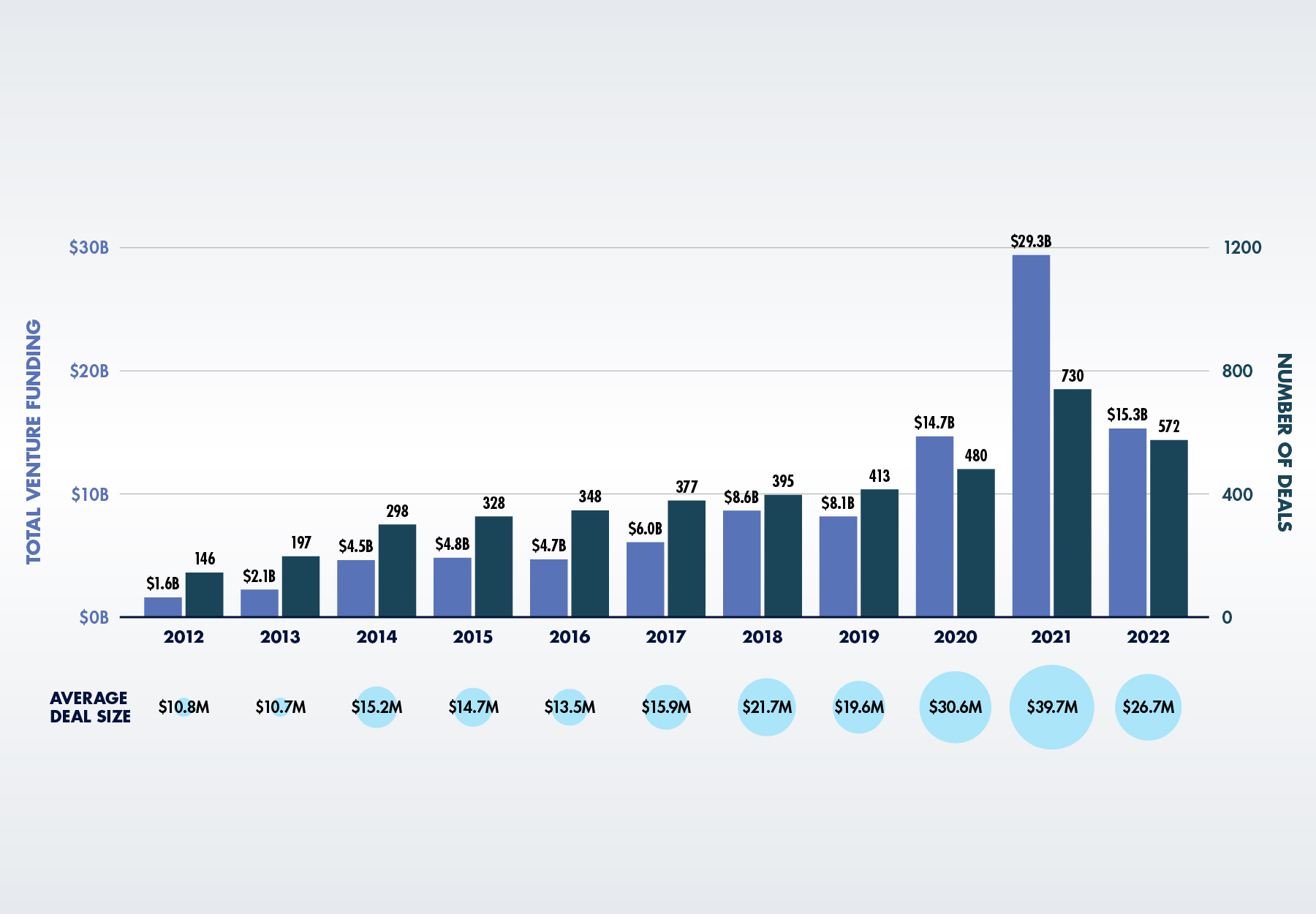

In an economy beset by inflation, interest rate hikes, and erosion of stock values, it’s surprising that digital health fundraising didn’t actually fare worse in 2022. During the year, digital health companies raised $15.3 billion across 572 deals. Those numbers actually best the $14.7 billion generated from 480 deals in 2020. But they pale in comparison to the 2021 highs of $29.3 billion raised in 738 deals. “Notably, 2022’s year’s Q4 $2.7 billion total was less than half of last 2021’s Q4 raise ($7.4 billion),” the Rock Health report points out. Average deal size year over year, shrunk from $39.7 million to $26.7 million.

Figure 1. US Digital Health Funding and Deal Size, 2012 to 2022

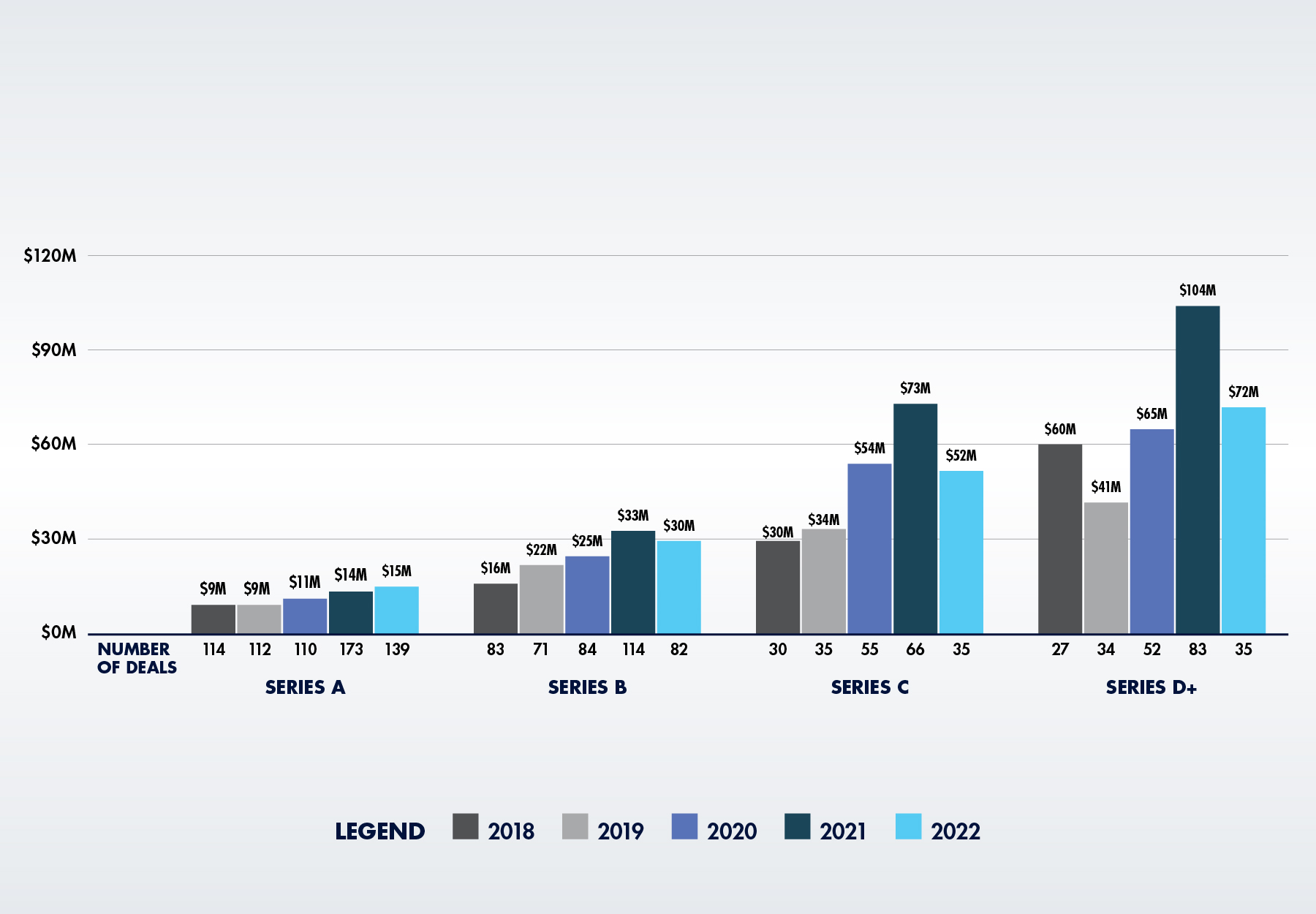

In terms of investment patterns, more money flowed toward early-stage digital health companies, as opposed to growth-stage companies that launched in 2020-2021 and thus were perceived as more likely to have inflated valuations. Consequently, while median deal sizes for all other later deal stages shrunk in 2022, Series A deals grew in deal size, reaching an all-time median high of $15 million.

Figure 2. Median Digital Health Deal Size, By Series, 2018 to 2022

The report also analyzes where investment dollars went during the year, noting that health and hospital systems focused on near-term solutions designed to cut costs, increase fees, enhance efficiency, and improve workflow in an attempt to counter the fiscal pressures caused by rising wages, staffing shortages, and reduced patient visits. Thus, for example, 45 percent of provider organizations reported that they accelerated their software investments to streamline operations in 2022.

Health systems also made strategic investments as part of a shift toward care models designed to minimize staff burnout and reduce operational burdens, such as hospital-at-home programs to free up hospital beds.

According to the report, it was an especially tough fundraising year for direct-to-consumer companies, which accounted for only 37 percent of the deals in 2022, as opposed to 43 percent in 2021. With inflation eroding consumers’ discretionary dollars, some companies, like Oura and Noom, began targeting employers by offering solutions to modernize health and wellness benefits.

The End of a Funding Cycle

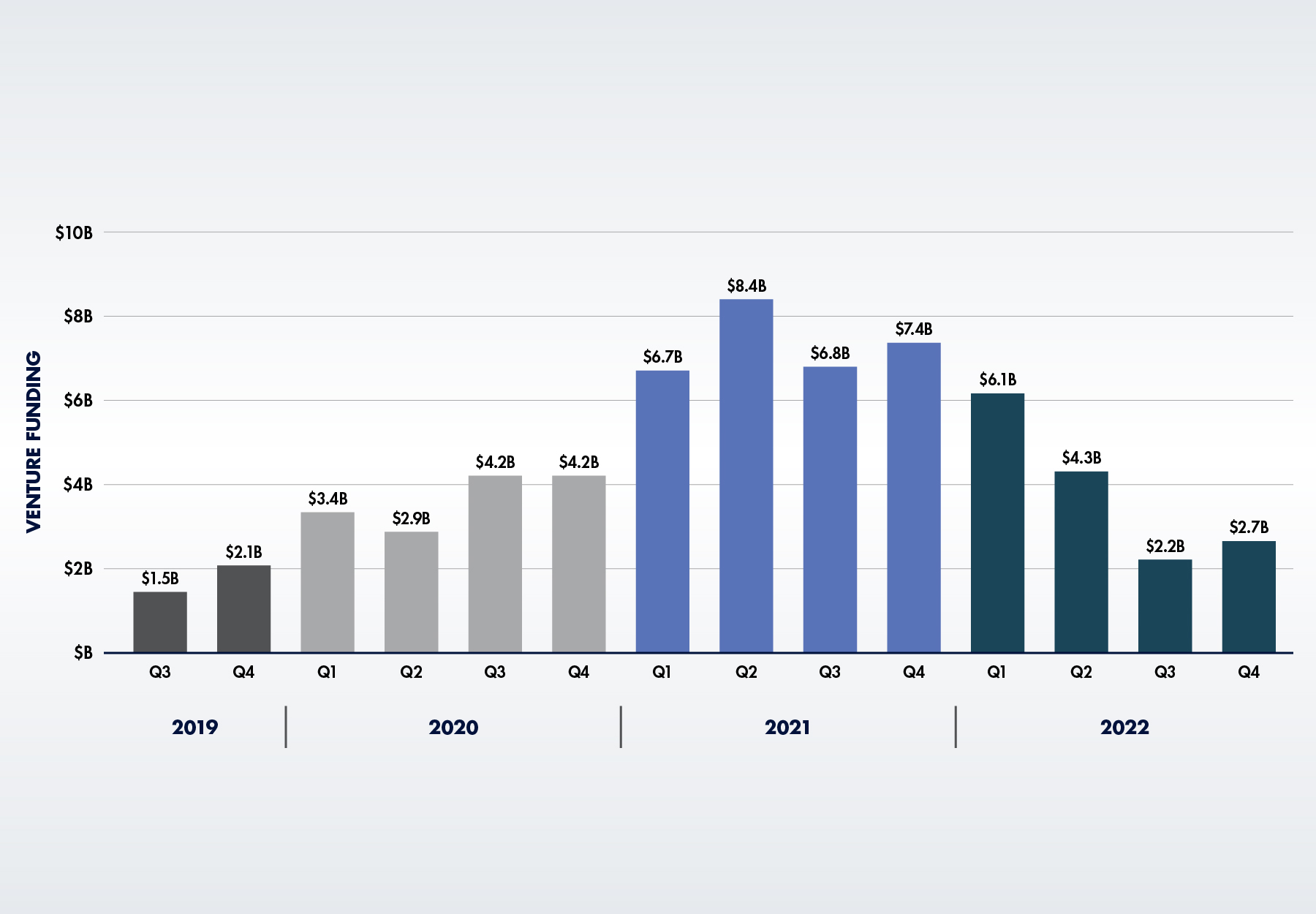

As the report title suggests, Rock Health views 2022 as representing the end of a broader macro funding cycle that began in Q3 2019 when quarter-over-quarter digital health investments increased in seven out of eight quarters, with the one dip occurring in Q2 2020. The cycle peaked in Q2 2021. After that, funding levels steadily dropped in every quarter, apart from modest increases in Q4 2021 and Q4 2022.

Figure 3. Consecutive Quarters of Digital Health Funding, Q3 2019 to Q4 2022

The upward trajectory of the cycle was driven by a number of factors that made investors more confident in making large bets on digital health, including:

- Digital health innovation spurred by the COVID-19 pandemic

- Government stimulus measures that artificially reduced cost of capital, and

- Regulatory reform

But after the 2021 Q2 peak, investors began pulling back, Rock Health notes, citing supply chain challenges, inflation, and interest rate hikes. What was at first a small decline gradually accelerated in the first six months of 2022 when average quarterly funding fell from $7.1 billion to $5.2 billion, before dropping to $2.4 billion during the second half of 2022. At $2.7 billion, Q4 2022 funding was 68 percent below the Q2 2021 peak of $8.48 billion.

What Happens Next?

The key question, of course, is whether we’ve reached the end of the latest digital health funding cycle or can expect more low funding quarters in 2023. It’s “too early to say” whether funding levels have bottomed out, Rock Health says. “With recession concerns looming,” digital health funding levels for 2023 might not exceed $10 billion, which would make it the lowest funding year since 2019, the report cautions.

However, Rock Health suggests that there are “signals” that investment will pick up again. The economic slowdown has enabled venture capital firms to stockpile cash for future investments. Meanwhile, the reduction of initial public offerings has made exit strategies difficult, which may put more late-stage digital health companies back in play.

The one thing that does seem certain is that the 2019 to 2021 growth surge was more anomaly than norm. If and when fundraising does pick up, Rock Health expects the trajectory to look more like it did back in 2011 to 2019 when growth was slower, more sustained, and more in line with startup risk and the prioritization of companies to take “measured paths to success.”

References:

- Rock Health, “2022 year-end digital health funding: Lessons at the end of a funding cycle.” January 9, 2023. Accessed at https://rockhealth.com/insights/2022-year-end-digital-health-funding-lessons-at-the-end-of-a-funding-cycle/

Subscribe to view Essential

Start a Free Trial for immediate access to this article