Digital Health Startup Fundraising Remains Robust Despite H1 2022 Declines

According to a recent report, digital health companies are on track to rake in $21 billion for 2022, below the 2021 total of $29.1 billion.

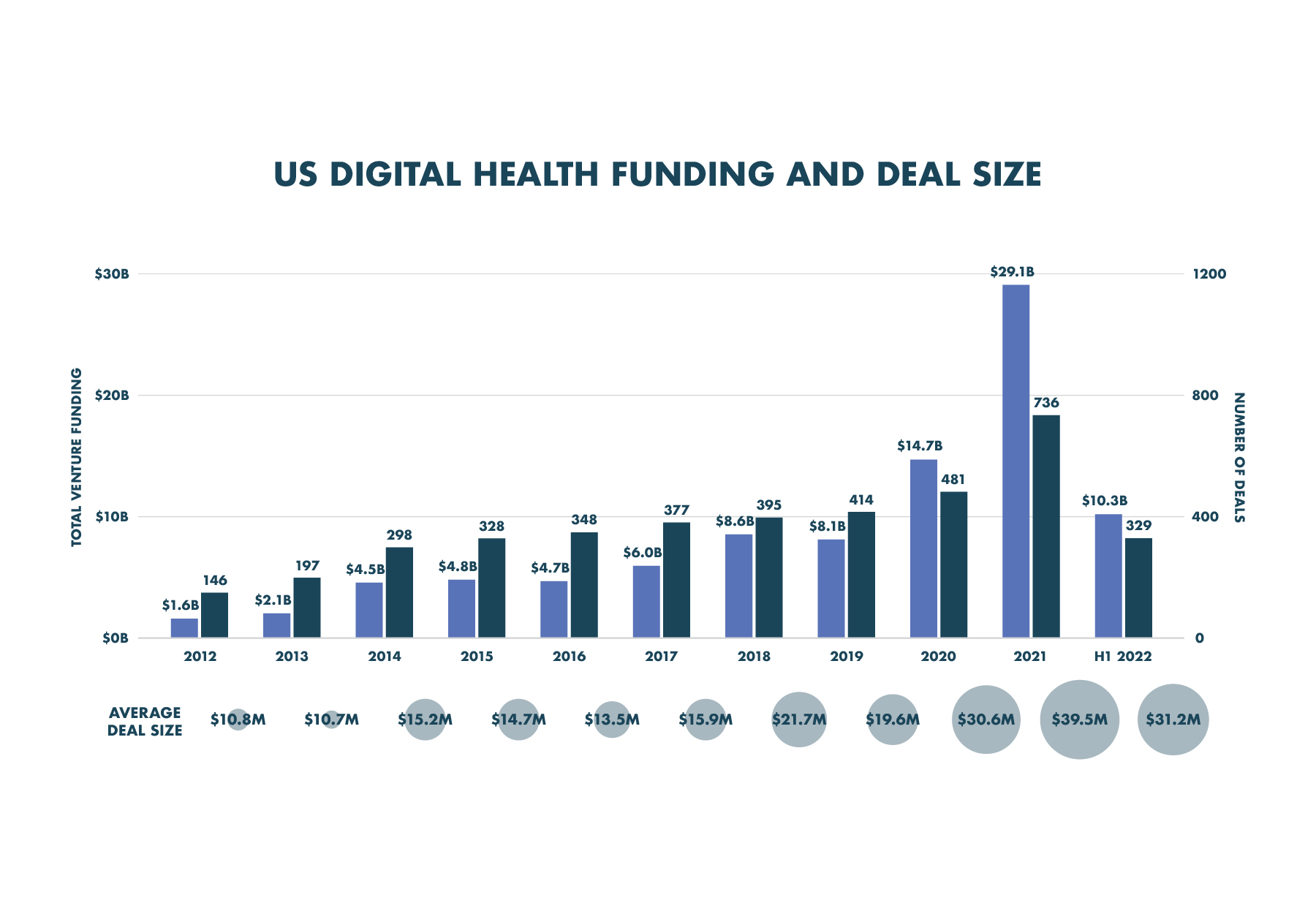

After the record year of 2021, capital raising by US digital health startup companies was due for a correction. Halfway through 2022, digital health companies had raised $10.3 billion and were on track to rake in approximately $21 billion for the entire year, significantly below the 2021 total of $29.1 billion. Those were the findings of venture capital analyst firm Rock Health’s recent report. But it may not be exactly an apples-to-apples comparison. Growth in 2021 was so spectacular that the year may prove to be something of an outlier; and while fundraising in 2022 will be down year over year, it will still exceed 2020 growth, according to Rock.

The Digital Health Sector

Rock’s analysis of digital health funding flows counts companies that build and sell technologies, including those paired with a service where the technology itself is the service. That includes companies like data warehouse platform builder Health Catalyst, online preventive health programs designer Omada Health, and Sotera Wireless, developer of the ViSi Mobile Patient Monitoring System.

Rock doesn’t count companies like Access MediQuip, Oscar, One Medical, and other firms that are innovative but focus on selling labor-intensive services, rather than technology. The analysis also counts only deals of $2 million or more.

The 2022 H1 Analysis

Digital health startups raised $10.3 billion across 329 deals during H1 2022, with an average deal size of $31.2 million. And after 23 public market exits in 2021, zero digital health companies went public in H1 2022 and a few public companies returned to private holdings. H1 was a tale of two quarters: Q1 was the best of times with $6.0 billion in funding across 183 deals (average deal size of $32.8 million), generally the same as funding levels of Q1 2021; but Q2 was the worst of times, with only $4.1 billion raised, the lowest funding quarter since Q2 2020 ($2.9 billion).

The sequential quarterly drop may be attributable to the fact that many of the deals announced in Q1 2022 were actually put together in Q4 2021 when investors were ramping up investments, especially in emerging sectors like digital health. But as the year began, the capital markets were rocked by global conflict and concerns over inflation.

New Investors Flee as Stalwarts Stay the Course

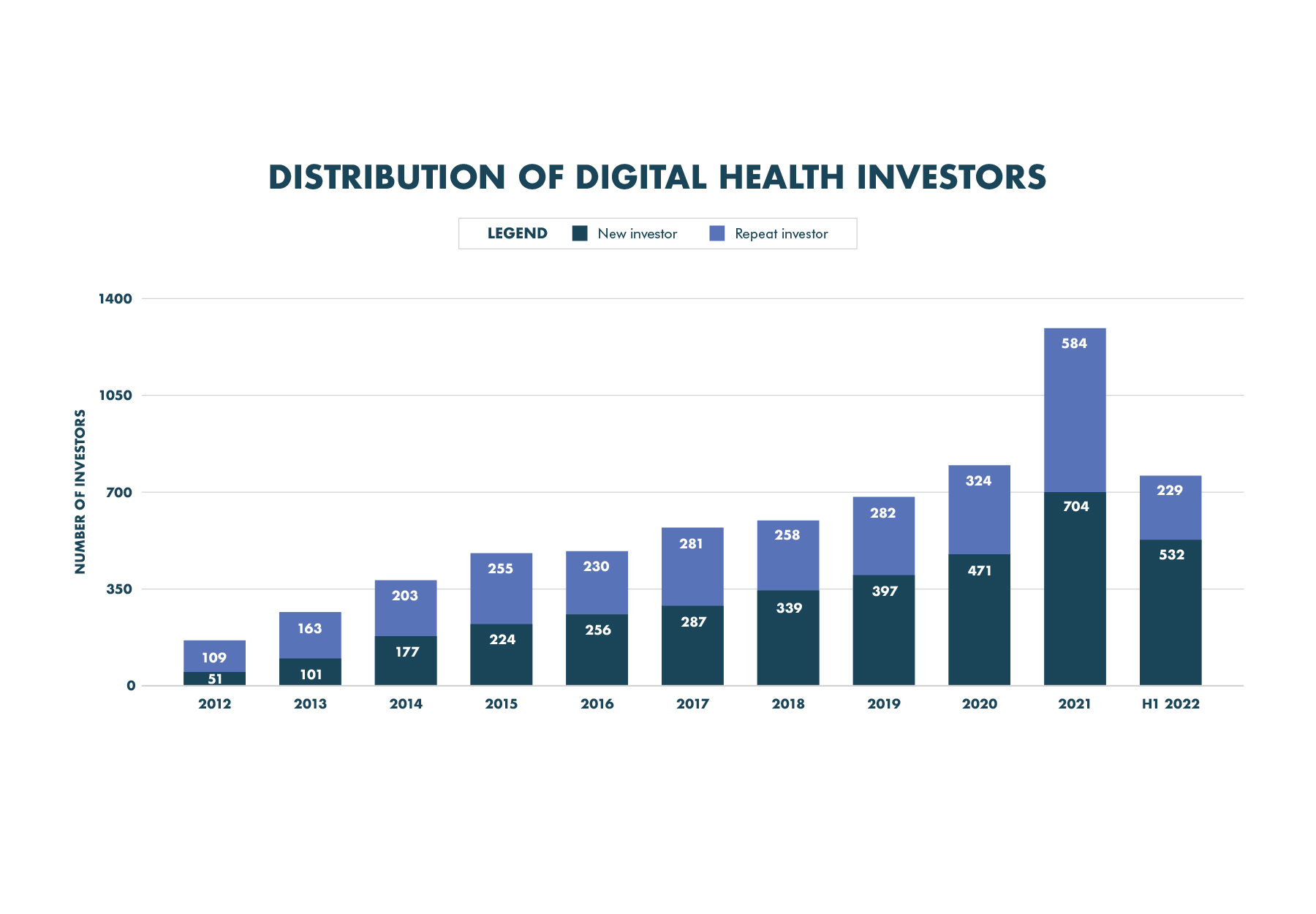

Thus began the retreat, especially among non-specialist investors. In contrast to previous years during which the sector had a fairly balanced mix between new and repeat investors, approximately 70 percent of digital health investors in H1 2022 were repeat investors. Rock expects this trend to continue, at least in the near-term, as the market remains volatile. The willingness of stalwarts to stay in the segment should keep investment flows steady through the shaky times.

Investment Patterns

B-stage digital health funding during the period dropped significantly, with H1 average Series B checks 25 percent smaller than in 2021. Rock suggests that investors in digital health startups entering their B phases “are returning to historical norms and pricing expectations” in looking for signs of financial sustainability and valuations that are unbloated and leave room for step-ups in later rounds.

According to Rock, investors will also be looking for seed and Series A startups with demonstrated market traction and a conservative cash management mindset, noting that digital health companies raised an average $18 million in Series A rounds during H1 2022, in line with 2021 averages.

Investment flows during H1 2022 followed familiar patterns. As usual, digital startups in the mental healthcare space was the clinical indication that raised the most capital, at $1.3 billion; however, all but $300 million of that total closed in Q1, led by Lyra Health’s $235 million capital raise in January. Investors also sank $1.6 billion into digital health startups catalyzing R&D in biopharma and medtech, led by Sema4 ($200 million), Verana Health ($150 million), and ConcertAI ($150 million).

In addition to the old favorites, Rock also noted funding increases for administrative and clinical workflow solutions supporting enterprises. As healthcare labor costs and burnout increase, investors are pouring their money into clinical and nonclinical (administrative) workflow support. Startups in this space raised the fourth most capital in H1 2022, led by cloud analytics and payments platform Clarify Health ($150 million).

Subscribe to view Essential

Start a Free Trial for immediate access to this article